Roth Ira 2025 Contribution Limits Over 50

Roth Ira 2025 Contribution Limits Over 50. The annual contribution limit for iras will remain at $7,000 for 2025. If you’re a single filer,.

These are the current roth contribution. You can contribute a maximum of $7,000.

Roth Ira 2025 Contribution Limits Over 50 Images References :

Source: mandybviolette.pages.dev

Source: mandybviolette.pages.dev

Ira Limits 2025 Over 50 Rubi Wileen, These limits apply to roth ira.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

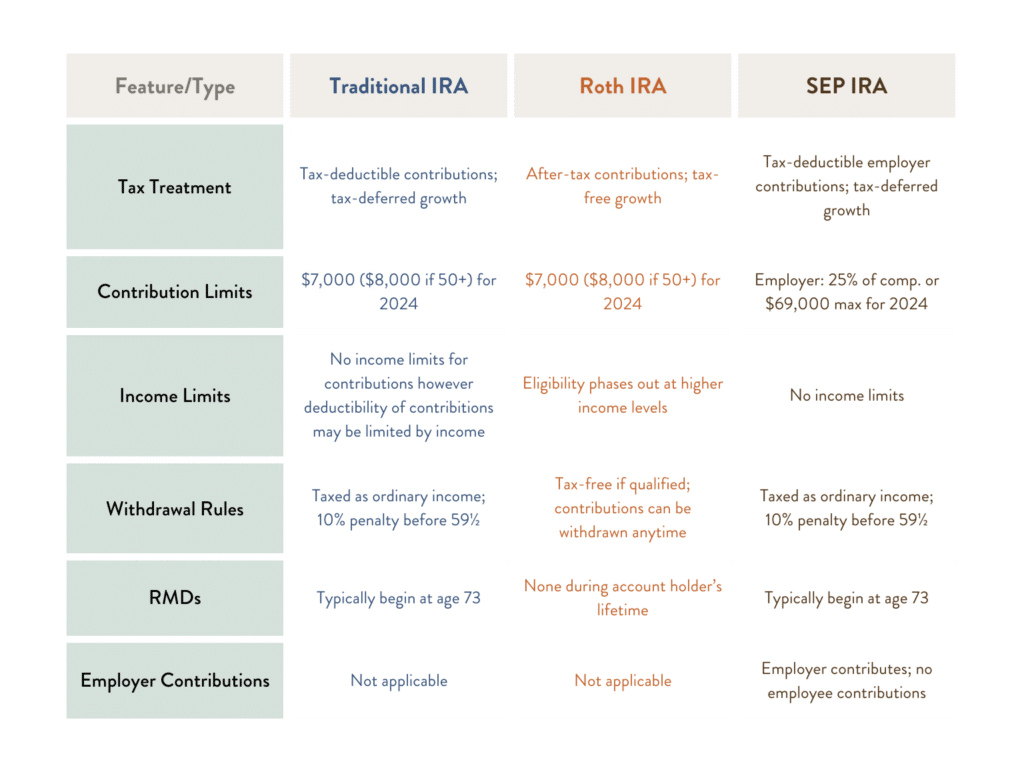

Roth IRA Limits And Maximum Contribution For 2021 2025, The contribution limits for a traditional or roth ira increased last year but remain steady for 2025.

Source: summitry.com

Source: summitry.com

Understanding Roth IRA Limits and Conversion Strategies Summitry, The 2025 roth ira income limit goes up by $4,000 for single filers and $6,000 for married filers filing jointly.

Source: alandavidson.pages.dev

Source: alandavidson.pages.dev

Simple Ira Contribution Limits 2025 Over 50 Natalie Baker, There is a maximum yearly amount that can be rolled over.

Source: clemblillian.pages.dev

Source: clemblillian.pages.dev

2025 Roth Contribution Limits Alene Karina, There is a maximum yearly amount that can be rolled over.

Source: cayecandide.pages.dev

Source: cayecandide.pages.dev

Roth Ira Contribution Limits 2024 Calculator Over 50 Eddie Gwennie, However, the secure 2.0 act.

Source: jacklewis.pages.dev

Source: jacklewis.pages.dev

Ira Limit 2025 Over 60 Jack Lewis, The 2025 catch‑up contribution limit for individuals aged 50 and over will stay at $1,000, the same rate from 2024.

Source: adanbrosalind.pages.dev

Source: adanbrosalind.pages.dev

Slmb Limits 2025 Dionis Donelle, The 2025 catch‑up contribution limit for individuals aged 50 and over will stay at $1,000, the same rate from 2024.

Source: maryanderson.pages.dev

Source: maryanderson.pages.dev

Maximum 401k Contribution 2025 Calculator Mary Anderson, The 2025 catch‑up contribution limit for individuals aged 50 and over will stay at $1,000, the same rate from 2024.

Source: neilaqanastasie.pages.dev

Source: neilaqanastasie.pages.dev

What Is The Max Roth Ira Contribution For 2024 Alyss Bethany, Contribution limits increase for tax year 2025 for hsas, sep iras, simple iras, and solo 401(k)s.

Category: 2025